what is fit on a pay stub

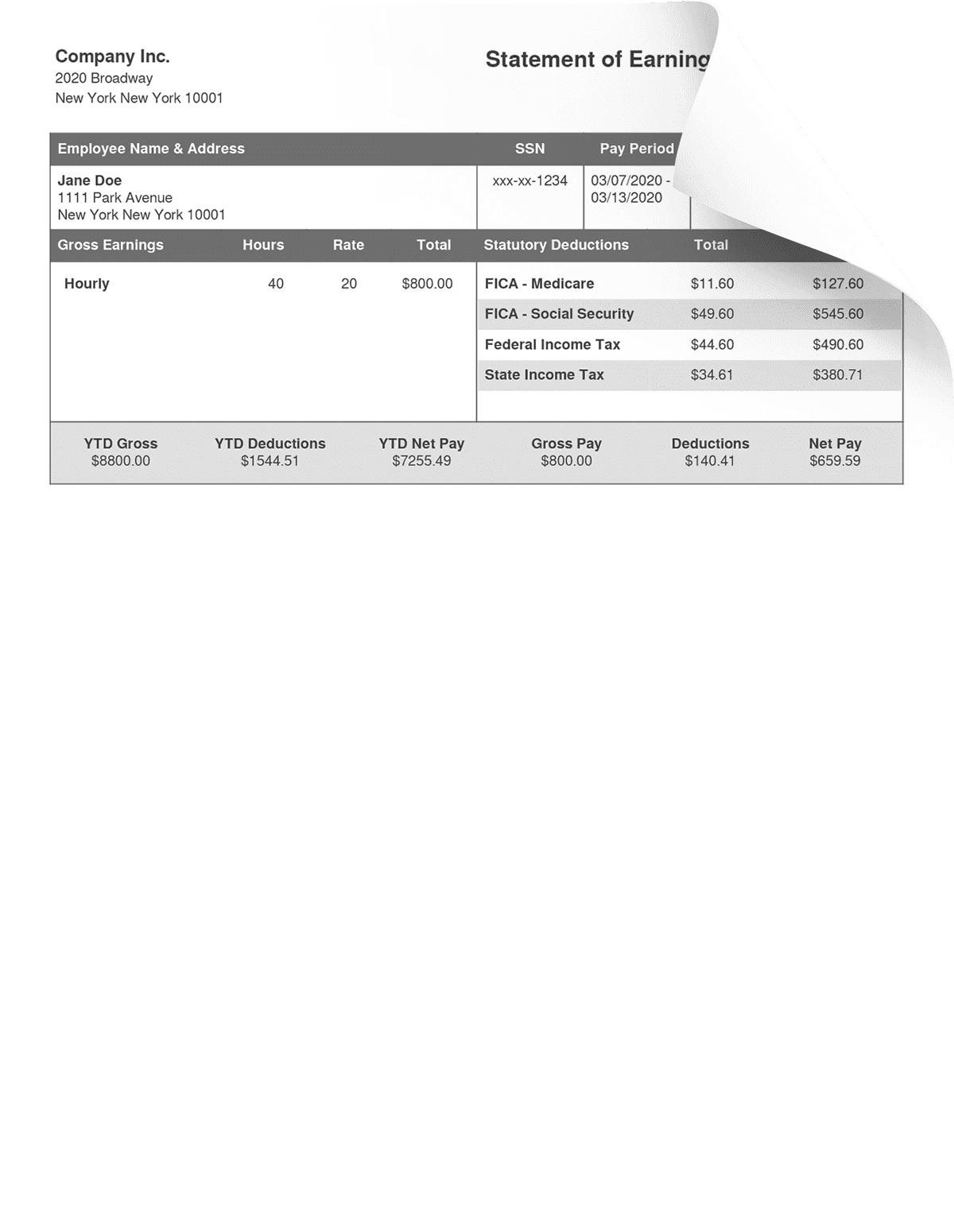

Social Security and Medicare. In most cases you will see money held back from your paycheck for two government-funded programs.

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed Org Payroll Template Word Template Templates

Fit on paycheck stub Thursday May 5 2022 Edit.

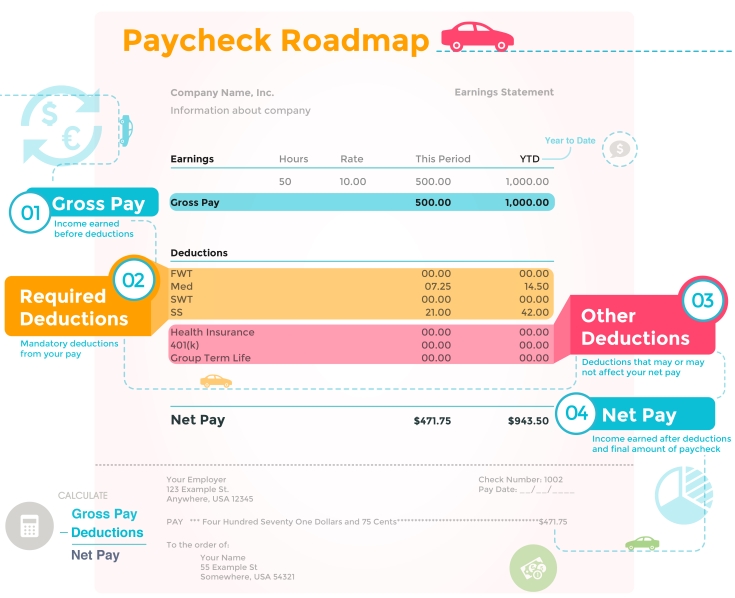

. On a pay stub this tax is abbreviated SIT which stands for state income tax. The federal government receiving the FIT taxes will typically use the funds to finance various federal programs and fund various sectors like education transportation energy and other areas. There are four types of taxes taken out of your paycheck every week.

Aside from tax deductions however there are some before-tax deductions that may appear on your paycheck stub as well. The check stub also shows taxes and other deductions taken out of an employees earnings. FIT stands for Federal Income Tax.

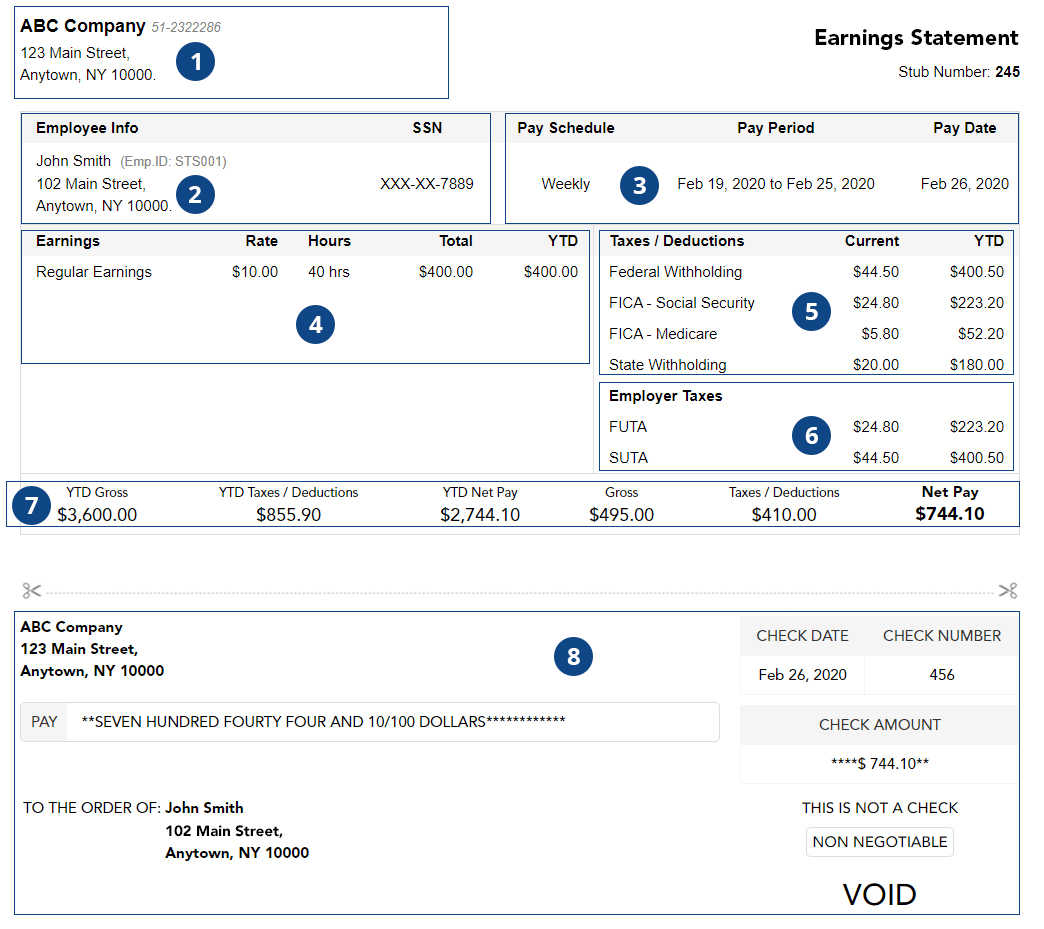

Here are some of the most common pay stub deduction codes demystified. Fit stands for federal income tax withheld. OT15 - Overtime pay at 15 times your regular pay rate OnCall - On-call pay.

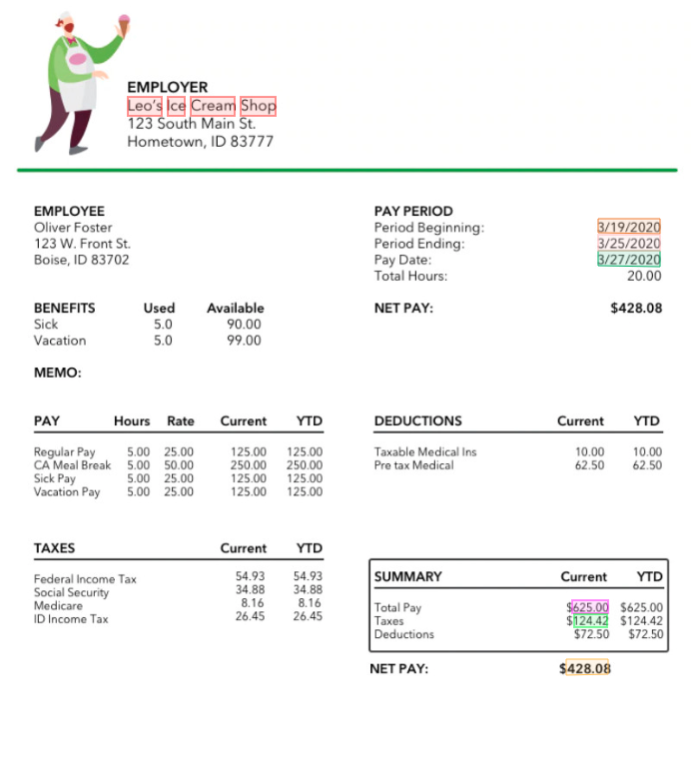

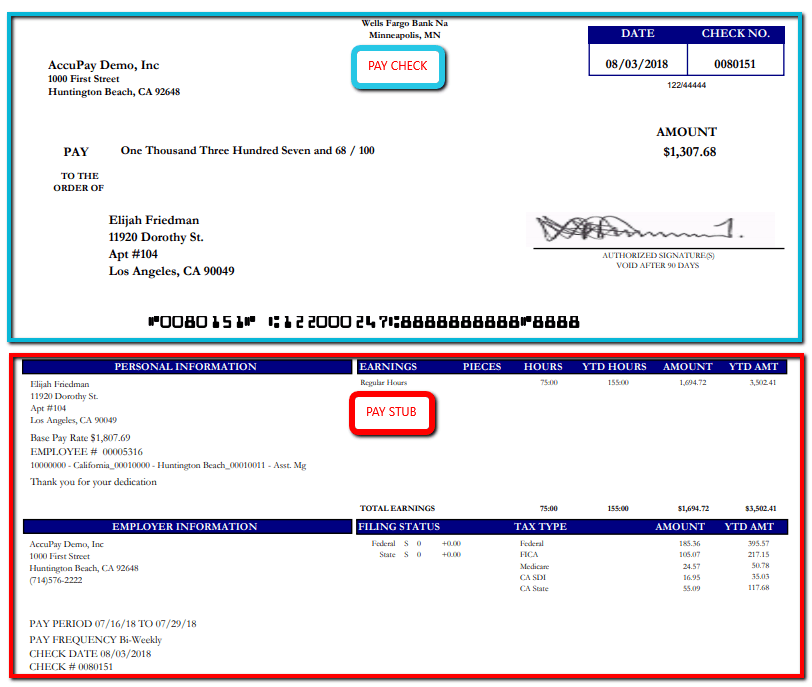

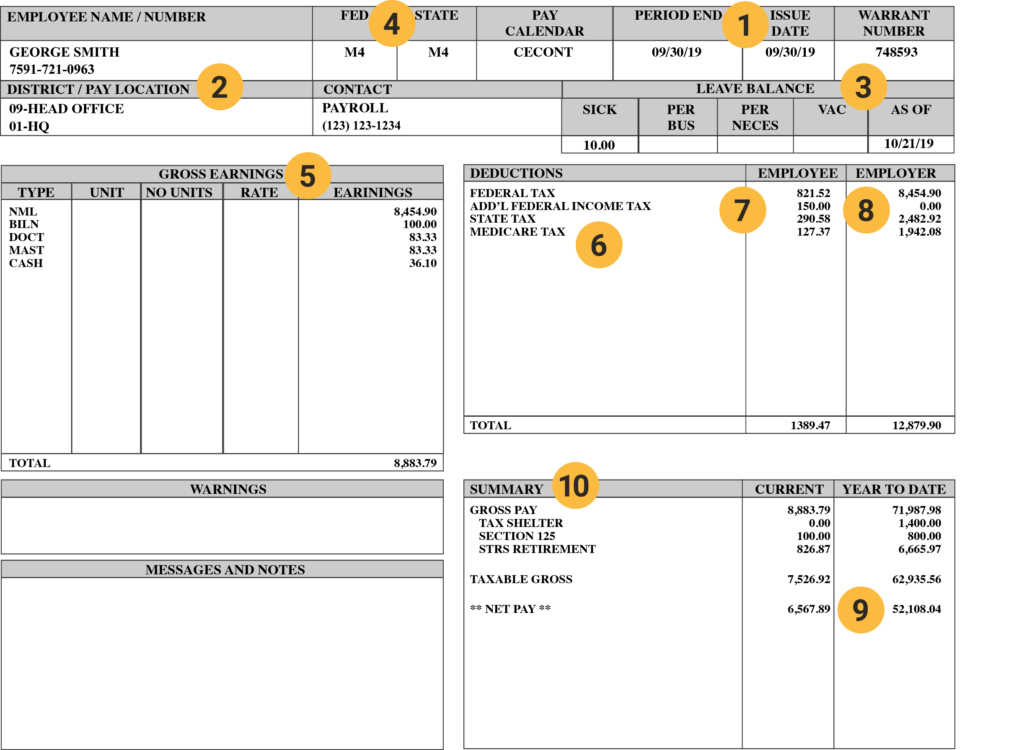

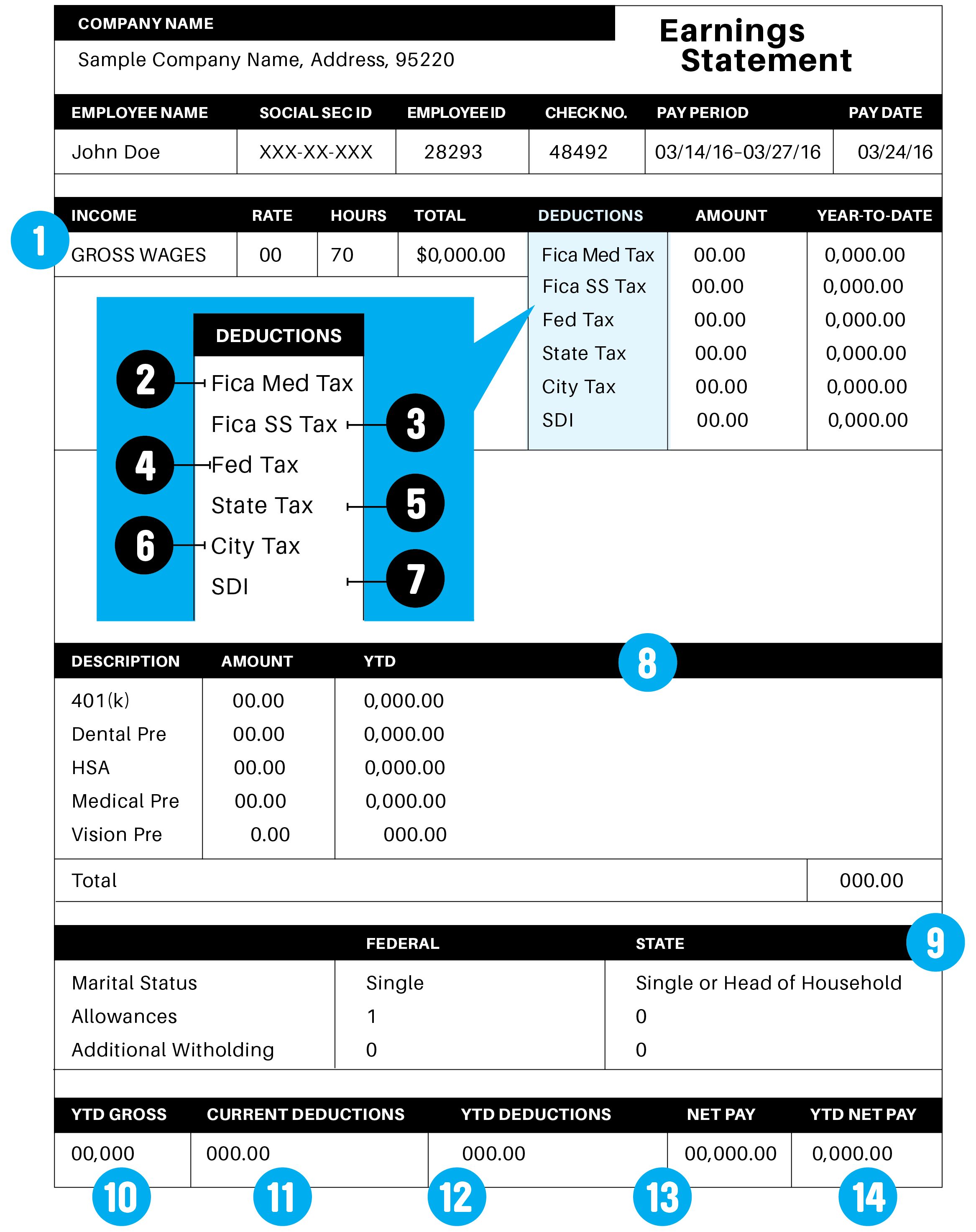

Common pay stub deductions include federal and state income tax as well as Social Security. Federal income tax Federal income. Pay stubs provide a helpful breakdown of gross pay net pay and all the deductions in between.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. They are all different taxes withheld. General Pay Stub Abbreviations.

FIT on a pay stub stands for federal income tax. FIT is applied to taxpayers for all of their taxable income during the year. PTO - Personal time off or paid time off.

FIT Fed Income Tax SIT State Income Tax. FED FIT or FITW. The rate is not the same for every taxpayer.

What does FIT EE on a payroll check mean. They go toward costs needed to run the federal government. Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization.

Some entities such as corporations and trusts are able to modify their rate through deductions and credits. The FIT gross is what I would expect to see in Box 1 of the W-2. FIT stands for federal income tax.

Misc - Miscellaneous pay pay they dont have a code for Move Rem - Move reimbursement. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. This is the amount of money earned during the pay period.

In the United States federal income tax is determined by the Internal Revenue Service. Local Tax Localcity tax withholdings. FedFWTFITFITW Federal tax withholding.

1 medicare and 2 social. Answer 1 of 2. FIT means federal income taxes.

This makes sense thank you. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. FIT stands for federal income tax.

What does fit mean paycheck. FIT is applied to taxpayers for all of their taxable income during the year. FICA stands for Federal Insurance Contributions Act.

A pay stub also known as a check stub is the part of a paycheck or a separate document that lists details about the employees pay. To keep errors to a minimum check your. FIT deductions are typically one of the largest deductions on an earnings statement.

OASDI FICA SS or SOCSEC. The Employees social security number. It covers two types of costs when you get to a retirement age.

Includes the total amount of income that you earned during a particular pay period. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken.

The name of the Employee. Your pay stub will also show how much youve earned during the year so far and for that pay period. A company specific employee identification number.

FIT is the amount required by law for employers to withhold from wages to pay taxes. So I assume on a payroll check. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

Some are income tax withholding. Below are the most common paycheck stub abbreviations that deal with before-tax deductions. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

This amount is based on information provided on the employees W-4. Jury - Jury duty pay. Reddits home for tax geeks and taxpayers.

It itemizes the wages earned for the pay period and year-to-date payroll information. The rate is not the same for every taxpayer. FICA means Federal Insurance Contribution Act.

The following items will appear on every paycheck stub and consumers need to fully comprehend their definitions and value. EE stands for employee. Your net income gets calculated by removing all the deductions.

A paycheck stub summarizes how your total earnings were distributed. Paycheck stubs are normally divided into 4 sections. These items go on your income tax return as payments against your income tax liability.

Personal and Check Information. A pay period is determined by your employer but is typically weekly bi-weekly every two weeks semi-monthly twice per month or monthly. Net - Earnings after taxes and deductions.

Reg Pay - Regular pay - hourly. Understanding Your Paycheck Credit Com Understanding Pay Stub Understanding Paycheck Stub. St TaxSWTSITSITW State tax withholding.

Here are some of the general pay stub abbreviations that you will run into on any pay stub. While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. Fit is applied to taxpayers for all of their taxable income during the year.

STATE SIT or SITW. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax. Fit stands for Federal Income Tax Withheld.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Usa Verizon Utility Bill Template In Word Format Bill Template Templates Lease Agreement Free Printable

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

A Guide On How To Read Your Pay Stub Accupay Systems

What Is The Purpose Of A Paycheck Stub Quora

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Understanding Your Paycheck Harmon Street Advisors

Hrpaych Yeartodate Payroll Services Washington State University

Anytime You Need A Paystub Our Site Makes It Quick And Effective To Generate The Paystub Y Business Checks Congratulations On Your Achievement Payroll Template

Understanding Your Paycheck Credit Com

Sample Pay Stub Opportunities For Wbc

What Everything On Your Pay Stub Means Money

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself

Understanding Pay Stub Understanding Paycheck Stub

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto